Each taxpayer is given a 15-digit GST number under the GST system (GSTIN). Apply for GST in India with the assistance of LegalCA Experts.

Every taxpayer under the Goods and Services Tax regime is given a unique identification number, which is referred to as their GST Number or GSTIN, which reduces the complexity associated with tax compliance.

What is a GST Number (GSTIN)?

The Goods and Services Tax Identification Number (GSTIN) is a unique 15-digit code assigned to each taxpayer registered for GST in India. Individuals or entities supplying goods or services with a gross turnover exceeding the threshold limit (Rs. 20 lakh for many states and Rs. 10 lakh for special category states) are required to obtain a GSTIN.

Learning the the Structure of the 15-Digit GST Number?

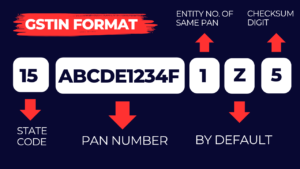

The Goods and Services Tax Identification Number (GSTIN), also referred to as the GST Number, is a 15-digit alphanumeric code assigned to each taxpayer under the Goods and Services Tax (GST) framework established in India. A method exists where each digit contributes to describing the business and its location.

Here is a format break-down of the GSTIN:

- The first two digits describesthe state code Every state has a unique code. For example,

- State code of Haryana is 06

- State code of Delhi is 07

- The next 10 digits will be the PAN number of the taxpayer

- The 13th digit will be assigned based on the number of registration within a state

- The 14th digit will be “Z” by just default

- The last digit will be for checksum digit

Who requires a GST number and what are the associated costs of getting a GSTIN?

A GST Number is mandatory for any business that exceeds particular turnover thresholds or engages in interstate trading. Registration can be completed at no cost using the official website. However, utilizing the services of professional may incur charges. A taxpayer may include an individual, a sole proprietorship, a partnership, an LLP, a company, or any other business structure that necessitates the obtaining of a GSTIN.

What are the Criteria for for GST Registration?

- Service providers are required to obtain GST registration when their annual turnover reaches ₹20 Lakhs, while goods suppliers must register when their turnover hits ₹40 Lakhs per annum.

- Businesses engaged in inter-state supply, offering e-commerce services, or those choosing voluntary registration regardless of their turnover are required to register under GST.

- This facilitates compliance with the Goods and Services Tax regime and allows businesses to engage in legal activities nationwide.

What are the Charges of Obtaining GSTIN?

- Registering for the GST using the GST portal incurs no fees, However, companies may choose to seek assistance from GST Suvidha Providers (GSPs) or other service providers, as this service can cost a charge.

- Utilizing such services can assist organizations in navigating complex registration processes; yet they are not mandatory for completing the process.

How to Apply for a GST Registration?

Step-by-Step Registration Process

Step 1 – To initiate the GST registration process, please visit the official GST portal and fill out Form GST REG-01.

Step 2 – Simply furnish the essential business information, such as type of business, and address.

Step 3 – Please ensure that all necessary documents are submitted and that the information is verified prior to application submission, It is essential to maintain accuracy to prevent delays or rejections resulting from discrepancies in the application.

Step 4 – Upon submission, a GST application reference number (ARN) will be generated, and the GSTIN will be assigned following successful verification.

Required Documents for GST Registration

- A PAN Card

- Proof of business registration like certificate of incorporation and such address proof like electricity bill, rent agreement etc.

- Identification and address proof of the owner(s) or promoters is also necessary along with government ids like Aadhaar etc

Steps for GSTIN Verification on the GST Portal

GSTIN verification can be done in the official GST site in the following way:

- Visit the GST Portal: Visit the official GST website.Check out for the ‘Search Taxpayer’ Section: Find the search for taxpayers’ GSTIN option.

- ENTER GSTIN : Enter the GSTIN of the vendor or the business concerned which you intend to verify. Search can also be done using PAN or Business name.

- Click on Search: When all the details have been filled in, press the trigger ‘Search’ to see the GSTIN verification details.

- Verify GST Status: The portal will provide for all information ithe business registered name and its GSTIN status whether active, registration type and return filing status.